Parallel Finance: Web3 Grant Announcement

Parallel Finance is very happy to announce it has received a Web3 grant!

Parallel was actually approved for the grant in April of this year, and we’ve been heads down building ever since. We weren’t able to announce our candidacy until we cleared a series of milestones set by the Web3 foundation [1]. As of early June 30th, Parallel received word that it has passed these milestones, and can officially announce the grant to build a decentralized lending and staking platform on Polkadot [2].

What is Parallel Finance?

Parallel is an institutional-grade lending solution building in the Polkadot ecosystem to empower regular people to earn interest on their assets with the utmost safety and security in mind. We chose to build in the Polkadot ecosystem because Polkadot (and Kusama by extension) allows for faster and cheaper transactions, shared security, interoperability, and strong upgradability. Our primary goal is to create an innovative lending system that uses the power of Polkadot to generate the greatest capital efficiency for everyone involved.

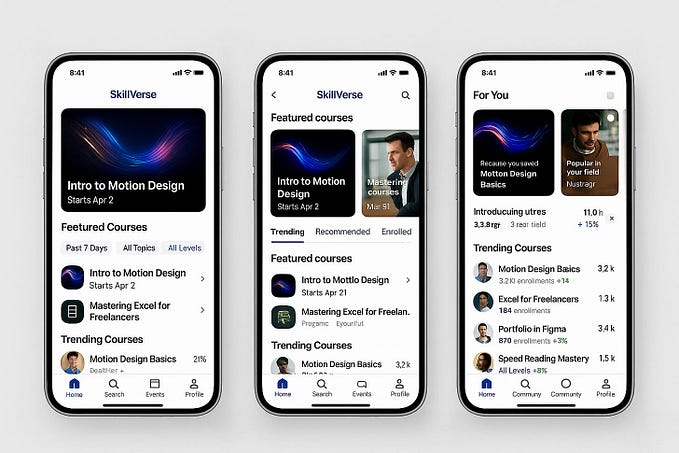

What We’ve Built So Far

We built a staking and lending interface on testnet that can be used to backtest upcoming features for the mainnet launch on Kusama, where we will deploy as soon as we win a parachain auction. This interface can be used to test a protocol known as “leverage staking,” which allows users to borrow against their staked KSM and DOT in order to earn lending yield on top of staking yield. The inspiration for this system comes from a series of seminal articles by Tarun Chitra et al, where he argues that staking and lending are in competition with each other [3]. Parallel is building a system that allows staking and lending to be in collaboration, rather than competition, which increases the overall security of the network while maxing out the user’s yield.

As a part of our approach, we’ve also built a node validator evaluation schema that uses our staking interface [4]. This schema is built to nominate the best validators for users based on the reputational history of these validators. We’ve also created educational material (tutorials and Medium articles) to allow users to interact with this new lending interface, and beta test our first version, which allows us to iterate and improve [5]. By building on Polkadot, we have been able to successfully develop these features because of its ease of interchain communication, shared security, and fully decentralized scalability.

Our Future Development Plans

In the near future, we plan to implement a fixed-rate parachain loan interface. The current plan is to make these “auction loans” composable with the current lending interface. This innovation was inspired by the parachain auction infrastructure at the core of Kusama and Polkadot [6]. Parachain auctions are used to determine which projects bring value to Polkadot and Kusama, and they are expected to lock up a very large percentage of the supply of DOT and KSM. In our current plan, users will be able to select crowdloans that they would like to participate in through Parallel’s interface, and projects seeking loans for a parachain auction can source them through Parallel’s interface [7]. Our hope for this feature is to give lenders and borrowers a simple and incredibly secure interface to participate in crowdloans.

In addition, we are in the process of developing a new way of dynamically tracking interest rates. One problem with floating interest rates is that they jump dramatically after the optimal utilization has passed. Our way of calculating interest rates allows for the most optimal range of utilization (roughly 80%) to generate the greatest yield for the lender, and the most reasonable interest rate appreciation for the borrower. Our hope is to create a dynamic way of tracking interest rates such that borrowers are not suddenly threatened by high interest rates, and lenders earn the highest fees in the optimal range of utilization [8].

How Parallel Contributes to the Polkadot Ecosystem

Every feature on Parallel is built to be symbiotic with the Polkadot ecosystem. Our leverage staking feature allows users to stake and secure the network without having to lose liquidity, lending yield, or capital efficiency. Our node validator evaluation schema allows users to stake comfortably while knowing that the nodes with the highest reputation will be securing the network. This decreases the risk of slashing, and helps secure the network by nominating the nodes with the strongest performance history.

The parachain loan concept, which is currently in development, helps the Polkadot ecosystem by making parachain loans more accessible to new projects, and by allowing users to stay liquid while they participate in parachain auctions. Optimizing parachain auctions for the end user, as well as parachain leaseholders, is ideal for the Polkadot ecosystem, because it increases the capital efficiency of parachains themselves, which are in fact fungible assets.

Web3 Foundation

Web3 Foundation funds research and development teams building the technology stack of the decentralized web. It was established in Zug, Switzerland by Ethereum co-founder and former CTO Gavin Wood. Polkadot is the Foundation’s flagship project. Learn more about Web3 Foundation by visiting their website, and stay up to date with the latest developments by following them on Medium or Twitter.

A special thanks to our partners for their continued support.

Join our community on Discord.

Follow Parallel…

Twitter | Telegram | Medium | Github

References

- https://github.com/w3f/General-Grants-Program/blob/master/grants/accepted_grant_applications.md

- https://github.com/w3f/Grant-Milestone-Delivery/pull/186

- https://arxiv.org/abs/2001.00919;

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3629988 - https://docs.parallel.fi/dev/staking/staking-election

- https://parallelfinance.medium.com/

- https://wiki.polkadot.network/docs/learn-parachains/

- https://docs.parallel.fi/

- https://docs.parallel.fi/dev/loans/interest-rate-model

Disclaimer:

This article contains forecasts, projections, goals, plans, and other forward-looking statements regarding Parallel’s financial results and other data. Such forward-looking statements are based on Parallel’s assumptions, estimates, outlook, and other judgments made in light of information available at the time of preparation of such statements and involve both known and unknown risks and uncertainties. Accordingly, plans, goals, and other statements may not be realized as described, and actual financial results, success/failure or progress of development, and other projections may differ materially from those presented herein. Even when subsequent changes in conditions or other circumstances make it preferable to update or revise forecasts, plans, or other forward-looking statements, Parallel disclaims any obligation to update or revise this article. Information concerning risk or returns (including features under development) contained herein is not intended as advertising or as financial advice.